Trading Algorithms for US Stock Indices

Revolutionize Your Strategy with Trading Algorithms

Experience Automated Trading Algorithms in Your Own US-Regulated Brokerage Account.

Join Over 1,000+ Users Utilizing $65M+ in Live Capital

Who's Algo Exchange & Why Implement Trading Algorithms?

Forged from a foundation in trading. Our automated trading systems trace back to empowering the founder of Algo Exchange in his trading journey. It was this success that sparked a vision to extend the algorithmic trading advantage to others, transforming individual insight into collective empowerment through trading algorithms.

We redefine engagement with financial markets, aiming to eliminate the complexities and risk often involved. Our platform ensures a streamlined, user-friendly experience, empowering retail investors to partake easily and confidently.

Our custom trading algorithms harness years of comprehensive data to execute precise trades, effectively mitigating the pitfalls of human error and emotional bias. This allows our users to benefit from a system where trading experience is not prerequisites for success.

Algo Exchange Simplifies The Essence Of Trading Algorithms

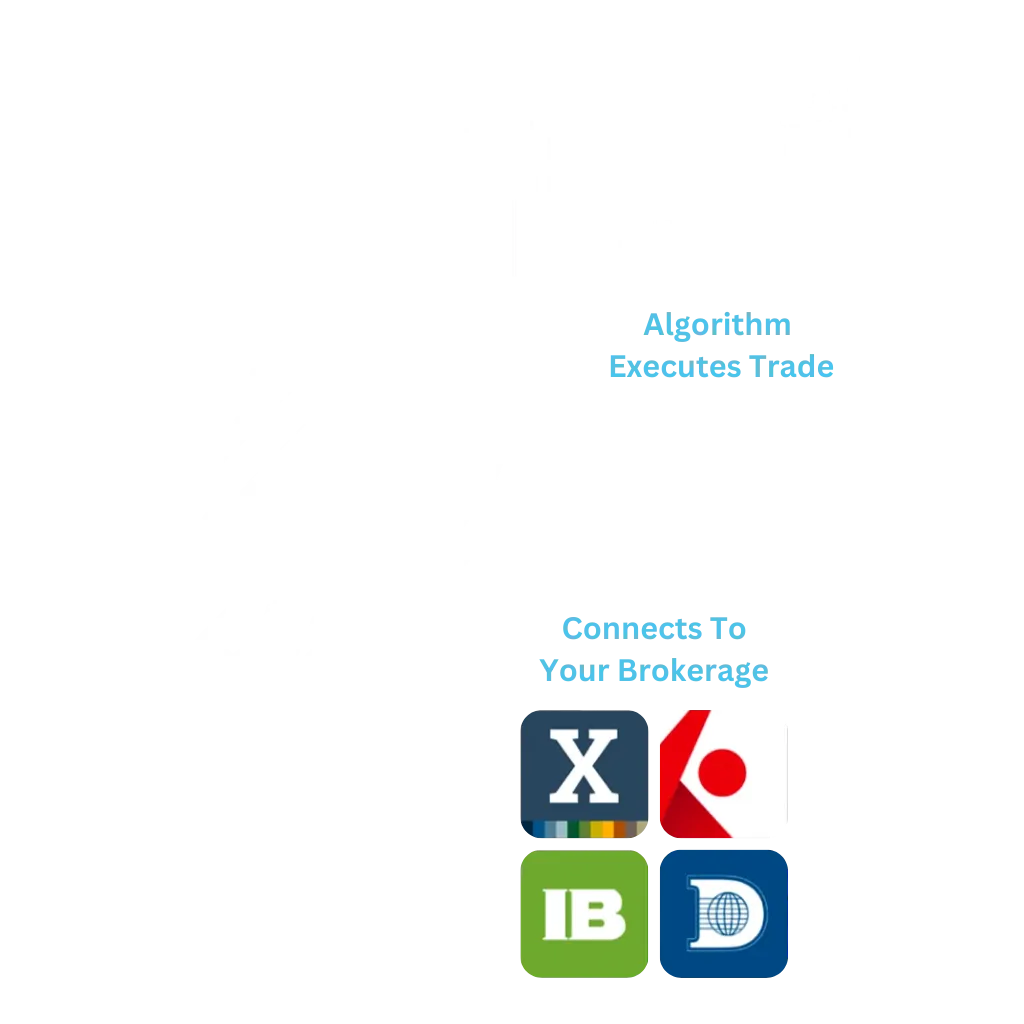

Trades Flow Seamlessly From Master Accounts On Our Servers, Through The Algo Exchange Platform, Directly To Brokerage Accounts Via Respective Broker APIs, Ensuring Swift And Efficient Executions.

Indeed, It's That Straightforward.

Embark On Your Algorithmic Trading Journey With Just A Few Clicks!

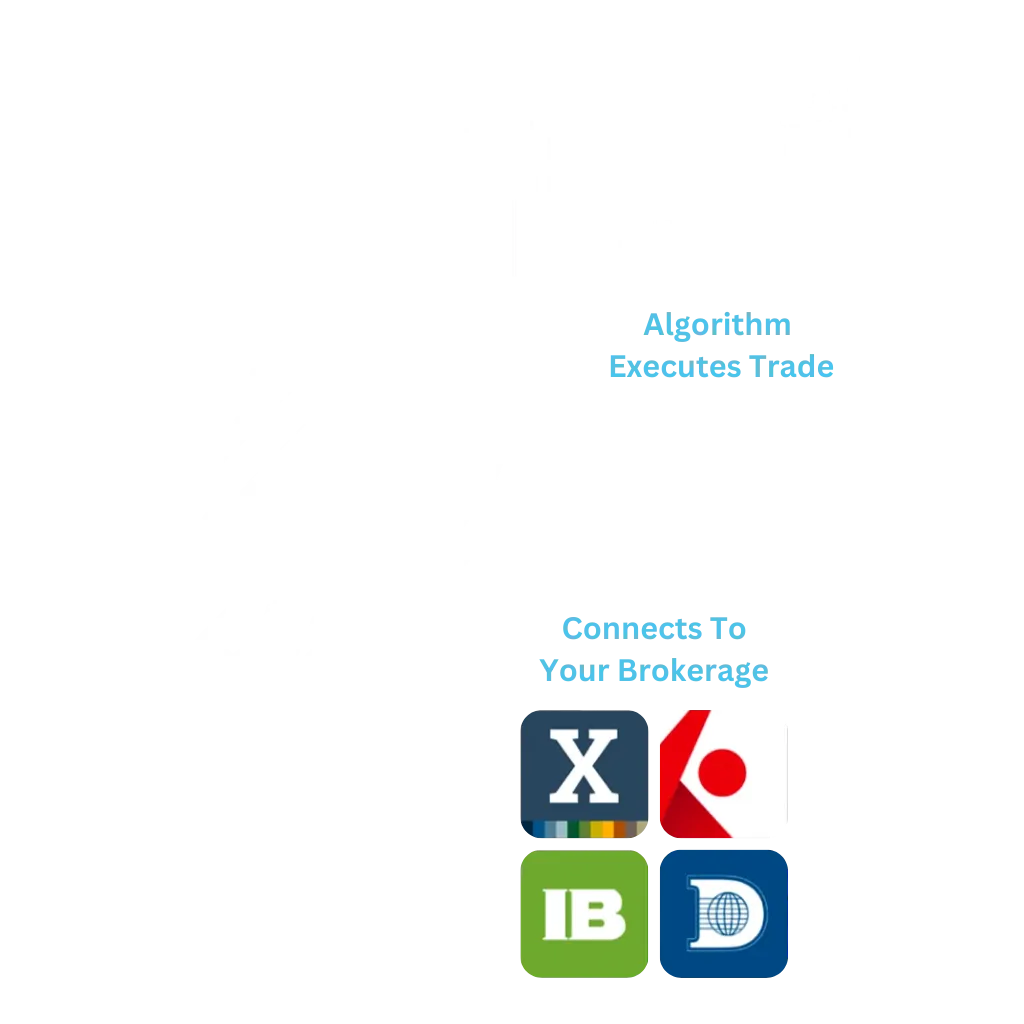

Which Brokerages Are Compatible With Algo Exchange?

Users can choose to trade with Interactive Brokers, StoneX, or Dorman Trading. All of these brokers are registered with the NFA and CFTC and are located in the United States. Interactive Brokers and StoneX are publicly traded companies.

How Can I Connect My Brokerage Account To Algo Exchange?

Integration is straightforward and user-friendly. Once you select and license an algorithm from our platform, you'll receive detailed instructions on how to connect it with your existing brokerage account at a US-regulated brokerage. Our support team is also available to guide you through the process step by step, ensuring a smooth setup without technical difficulties.

Does Algo Exchange Have Access To My Brokerage Account And Funds?

No, only you can access your account. All you give our software permission to do is execute trades from our server to your account. We do not have access to your account and cannot access your capital at all. We simply transmit trade data from our platform to your trading account.

Are Algo Exchange's Trading Algorithms Beginner Friendly?

Yes, our trading algorithms and scripts are designed to accommodate both beginners and experienced traders. For beginners, we offer algorithms that operate with pre-set strategies, requiring minimal input. We also provide comprehensive educational resources and support to help you understand how the algorithms work and how to manage them effectively. For experienced traders, our platform offers the flexibility to customize strategies to fit their specific trading goals and risk tolerance.

How Can I Select the Most Suitable Trading Algorithm?

Choosing the right trading algorithm depends on several factors, including your trading style, risk tolerance, and investment goals. We recommend starting by reviewing the detailed descriptions and performance metrics available for each algorithm on our platform. Our customer service team is also available to answer any questions you may have about each of our algorithms.

What Variety Of Trading Algorithms Does Algo Exchange Offer?

Our platform offers over 10+ automated trading algorithms that accommodate to a diverse range of trading strategies and preferences in the futures market. Each algorithm is designed to seamlessly integrate with trusted US-regulated brokerages, providing a streamlined and efficient trading.

Do The Algorithms On Algo Exchange Differ From Each Other?

They all trade different strategies. So the reasons why they take trades is all different. Also, they all will trade different position sizes based on the minimum account balance for each system because some systems may scale in and out of trades. Some strategies will hold positions longer or shorter than other systems... overall they are all very different from each other. Our systems are all made by various developers and traders, we do our best to make sure that strategies are not overly correlated to each other while still being able to work effectively. The main thing here is finding a system that trades in a way that you are comfortable with, in terms of rate of return, frequency, and win/loss size. Even though we protect the logic, we still want you to know what you’re getting into and know what to expect and be comfortable with it.

What Trading Strategies Do Algo Exchange's Algorithms Utilize?

Every strategy has a different rule set, and they are all different. Some of our strategies are momentum strategies, some are mean reversion strategies, some are trend following strategies etc. Considering these are Black Box strategies, we cannot get into too much detail, but we can certainly give you an idea of what category they would fall into.

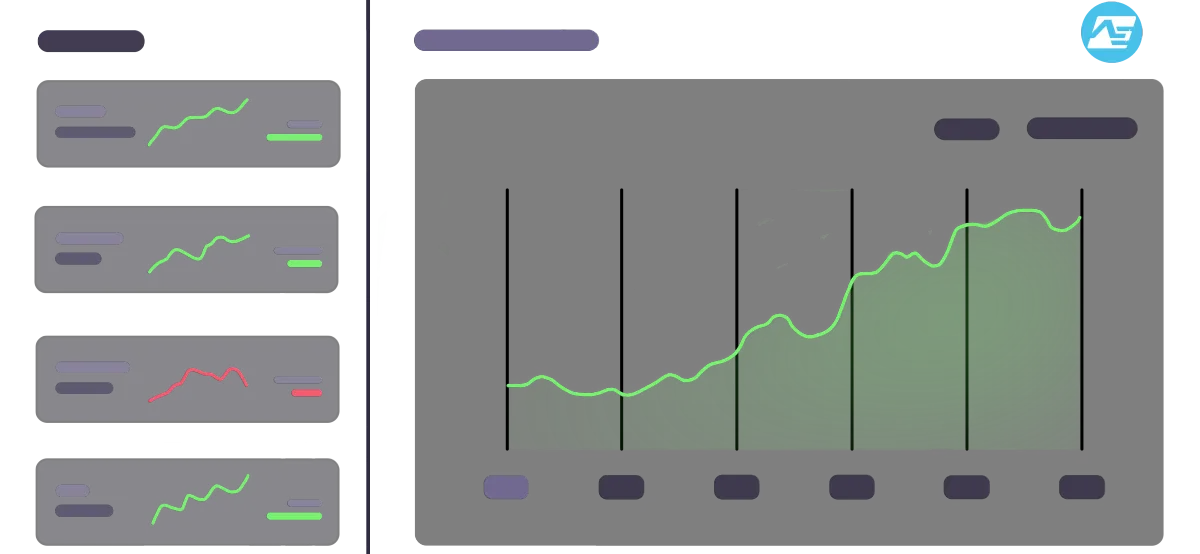

Can I Assess The Performance Of Each Algorithm To Identify The Best?

Yes, you can see the track record on our platform. We report every single trade signal. Any time the system fires off a trade signal, not only is it reported to the main performance record, but it's also shows every single trade signal actually being taken by a live brokerage account as well.

How Do Algo Exchange's Trading Systems Manage Position Sizing?

The sizing is pre coded into the strategy. Each strategy will trade a different position size. It is part of the risk management strategy of each system. You can set contract limits on whatever system you trade in case you want to limit it from taking on more contracts than you would like to. We don’t really breakdown why each system is entering a position, and we carry that same level of confidentiality into the position sizing as well, but what I can say is that some systems will scale into trades with individual contracts, other will enter all at once and scale out, overall every strategy is different.

What Is The Maximum Position Size Permitted On Algo Exchange?

We do not share that particular information, as everything is black boxed, but if you wanted to set a contract limit you can do that in the control panel on our platform so your account would never exceed that. A good gauge to use would be look at the trade history, notice the average position size, and then set a limit that is a bit higher than what you usually see. This would prevent any major unforeseen randomly large trades in your account.

Will Limiting My Position Size Negatively Impact My Outcomes?

Yes it could. For example, if a trade fires with 2 contracts and hits a target, but then takes a trade with 4 contracts and loses, then there would be a discrepancy depending on the ratio of the win to loss for that example. Overall, we display the default trade settings for each system on the trade record. If you subscribe to the system and leave the settings default, then what you see on the trade log would match your brokerage account performance as well.

How Do Algo Exchange's Algorithms Approach Risk Management?

Each system has preset ways to manage risk. Whether it be based on a fixed movement size such as a stop based on points, average true range, percentage change, or fixed dollar amount. They are all different, so the main thing would be to take a look at the trading history for each system and overall just consider if the losses and returns are something you are comfortable with. You can also set your own risk controls in terms of setting a fixed dollar stop, so you never have a larger loss than you are personally comfortable with in your control panel.

Do Systems Operate Overnight, Or Are They Exclusively For Day Trading?

Some of the systems will hold positions during after hours, while some also hold overnight and are swing trading systems, but most of our systems are intraday systems - meaning they open and close trades during the same trading session. For example you can see with our system, Apollo Algo, it is a swing trading system with an average hold time of over 3 days.

Why Would A Trader Share Their Trading Strategies And Platform?

Some systems we purchase the commercial rights to, others we have arrangements with the developer and trader that financially motivates them, and some traders don’t have an automated system, but have a great strategy, and we will actually have our developers code an algorithm and provide it to them, so they can run it on an automated basis as well to streamline their workflow. Overall we have a unique business model that works for everyone involved.

Do I Need To Download Anything Or Leave It On To Execute Trades?

No. This is entirely cloud based. We run the trading program and algorithms on our own servers, which transmit directly to our platform, which sends the signal to your brokerage. You don’t even need to have a computer turned on. Just set it up once, turn it on, and that’s it. No participation from you is required at all beyond originally turning it on and managing your settings based on your risk tolerance and goals.

Does Algo Exchange Utilize Black Boxes, Gray Boxes, Or White Boxes?

Algo Exchange uses Black Box, which restricts the user from seeing or understand the rule set or logic for the trading system. A gray box would be where some of the logic is transparent, for example, perhaps a risk layer. And a white box would be where it's totally transparent.

Does Algo Exchange Develop And Maintain Their Trading Algorithms?

All of the systems that run on our platform are built and developed by various quants that we work with. We do have an in house developer, but we also work with some existing strategies from traders that are in our network. Our founder works with many different traders and developers to build up a diverse library of trading systems. We also work with traders who provide us logic and we turn it into code, so overall our systems come from multiple talented traders.

What Happens If There Are Updates To My Rulesets By The Developers?

It is instantly updated onto the production version on our platform. Market environments are ever changing and may require updates on the backend to ensure performance. It’s part of the industry and we always make sure that when an update is ready and pushed into production that it is live on the platform. All of our systems do go through testing cycles, first on historical data, then on live data to make sure everything is effective, and then it is published for use on the site.

How Is The Plumbing Configured And How Does The IT Structure Look?

All of our systems run on servers. From there when a trade is triggered from any system, it is fired over to our platform API, and is then fired to the brokerage API to execute the trade for you.

Does Lag Between The Servers And My Account Effect The Performance?

No. Since we do not have High Frequency Trading systems and our algorithms have decent sized targets on top of us using high performance servers next to data centers, the low latency does not effect the trade outcomes in a significant way. There may be a tick or two of slippage, but overall it is not detrimental.

Does Algo Exchange Guarantee Any Type Of Performance?

No. Past Performance is not indicative of future results. Algo Exchange does NOT guarantee performance.

Does Algo Exchange Make Any Recommendations On Which Strategies To Use?

No. It is entirely the user’s choice on what strategies to use. Algo Exchange simply offers users with the ability to connect any of our trading algorithms to their own account. Algo Exchange does not give personalized advice or recommendations. All of our servers have backup power in terms of battery back ups for each machine, and the building has a generator as well, so two back up power sources. We also have backup fiber optic internet in case the main fiber line goes down. Up time is very important and we do our best to have the best resources we can.

Seeking Clarity?

Schedule A Video Call For A Comprehensive Guide Through Our Platform!

Subscribe To Algo Exchange & Discover The Benefits of Trading Algorithms

Receive valuable tips, news, and special promotions.

DISCLOSURE: Trading involves significant risks. Our algorithms are based on simulated data with inherent limitations and may not accurately predict actual market conditions. While our algorithms are rigorously tested, their past performance does not guarantee future results. Always approach trading with caution and consider potential risks before utilizing any algorithm.

For additional disclosure information, click HERE

Copyright © 2026 Algo Exchange. All Rights Reserved.

Trading Algorithms for US Stock Indices

Revolutionize Your Strategy with Trading Algorithms

Experience Automated Trading Algorithms in Your Own US-Regulated Brokerage Account.

Join 1,000+ Users Utilizing $65M+ in Capital

Who's Algo Exchange & Why Implement Trading Algorithms?

Forged from a foundation in trading. Our automated trading systems trace back to empowering the founder of Algo Exchange in his trading journey. It was this success that sparked a vision to extend the algorithmic trading advantage to others, transforming individual insight into collective empowerment through trading algorithms.

We redefine engagement with financial markets, aiming to eliminate the complexities and risk often involved. Our platform ensures a streamlined, user-friendly experience, empowering retail investors to partake easily and confidently.

Our custom trading algorithms harness years of comprehensive data to execute precise trades, effectively mitigating the pitfalls of human error and emotional bias. This allows our users to benefit from a system where trading experience is not prerequisites for success.

Algo Exchange Simplifies The Essence Of Trading Algorithms

Trades Flow Seamlessly From Master Accounts On Our Servers, Through The Algo Exchange Platform, Directly To Brokerage Accounts Via Respective Broker APIs, Ensuring Swift And Efficient Executions.

Indeed, It's That Straightforward.

Embark On Your Algorithmic Trading Journey With Just A Few Clicks!

Which Brokerages Are Compatible With Algo Exchange?

Users can choose to trade with Interactive Brokers, StoneX, or Dorman Trading. All of these brokers are registered with the NFA and CFTC and are located in the United States. Interactive Brokers and StoneX are publicly traded companies.

How Can I Connect My Brokerage Account To Algo Exchange?

Integration is straightforward and user-friendly. Once you select and license an algorithm from our platform, you'll receive detailed instructions on how to connect it with your existing brokerage account at a US-regulated brokerage. Our support team is also available to guide you through the process step by step, ensuring a smooth setup without technical difficulties.

Does Algo Exchange Have Access To My Brokerage Account And Funds?

No, only you can access your account. All you give our software permission to do is execute trades from our server to your account. We do not have access to your account and cannot access your capital at all. We simply transmit trade data from our platform to your trading account.

Are Algo Exchange’s Trading Algorithms Beginner Friendly?

Yes, our trading algorithms and scripts are designed to accommodate both beginners and experienced traders. For beginners, we offer algorithms that operate with pre-set strategies, requiring minimal input. We also provide comprehensive educational resources and support to help you understand how the algorithms work and how to manage them effectively. For experienced traders, our platform offers the flexibility to customize strategies to fit their specific trading goals and risk tolerance.

How Can I Select The Most Suitable Trading Algorithm?

Choosing the right trading algorithm depends on several factors, including your trading style, risk tolerance, and investment goals. We recommend starting by reviewing the detailed descriptions and performance metrics available for each algorithm on our platform. Our customer service team is also available to answer any questions you may have about each of our algorithms.

What Variety Of Trading Algorithms Does Algo Exchange Offer?

Our platform offers over 10+ automated trading algorithms that accommodate to a diverse range of trading strategies and preferences in the futures market. Each algorithm is designed to seamlessly integrate with trusted US-regulated brokerages, providing a streamlined and efficient trading.

Do The Algorithms On Algo Exchange Differ From Each Other?

They all trade different strategies. So the reasons why they take trades is all different. Also, they all will trade different position sizes based on the minimum account balance for each system because some systems may scale in and out of trades. Some strategies will hold positions longer or shorter than other systems... overall they are all very different from each other. Our systems are all made by various developers and traders, we do our best to make sure that strategies are not overly correlated to each other while still being able to work effectively. The main thing here is finding a system that trades in a way that you are comfortable with, in terms of rate of return, frequency, and win/loss size. Even though we protect the logic, we still want you to know what you’re getting into and know what to expect and be comfortable with it.

What Trading Strategies Do Algo Exchange's Algorithms Utilize?

Every strategy has a different rule set, and they are all different. Some of our strategies are momentum strategies, some are mean reversion strategies, some are trend following strategies etc. Considering these are Black Box strategies, we cannot get into too much detail, but we can certainly give you an idea of what category they would fall into.

Can I Assess The Performance Of Each Algorithm To Identify The Best?

Yes, you can see the track record on our platform. We report every single trade signal. Any time the system fires off a trade signal, not only is it reported to the main performance record, but it's also shows every single trade signal actually being taken by a live brokerage account as well.

How Do Algo Exchange's Trading Systems Manage Position Sizing?

The sizing is pre coded into the strategy. Each strategy will trade a different position size. It is part of the risk management strategy of each system. You can set contract limits on whatever system you trade in case you want to limit it from taking on more contracts than you would like to. We don’t really breakdown why each system is entering a position, and we carry that same level of confidentiality into the position sizing as well, but what I can say is that some systems will scale into trades with individual contracts, other will enter all at once and scale out, overall every strategy is different.

What Is The Maximum Position Size Permitted On Algo Exchange?

We do not share that particular information, as everything is black boxed, but if you wanted to set a contract limit you can do that in the control panel on our platform so your account would never exceed that. A good gauge to use would be look at the trade history, notice the average position size, and then set a limit that is a bit higher than what you usually see. This would prevent any major unforeseen randomly large trades in your account.

Will Limiting My Position Size Negatively Impact My Outcomes?

Yes it could. For example, if a trade fires with 2 contracts and hits a target, but then takes a trade with 4 contracts and loses, then there would be a discrepancy depending on the ratio of the win to loss for that example. Overall, we display the default trade settings for each system on the trade record. If you subscribe to the system and leave the settings default, then what you see on the trade log would match your brokerage account performance as well.

How Do Algo Exchange's Algorithms Approach Risk Management?

Each system has preset ways to manage risk. Whether it be based on a fixed movement size such as a stop based on points, average true range, percentage change, or fixed dollar amount. They are all different, so the main thing would be to take a look at the trading history for each system and overall just consider if the losses and returns are something you are comfortable with. You can also set your own risk controls in terms of setting a fixed dollar stop, so you never have a larger loss than you are personally comfortable with in your control panel.

Do Systems Operate Overnight, Or Are They Exclusively For Day Trading?

Some of the systems will hold positions during after hours, while some also hold overnight and are swing trading systems, but most of our systems are intraday systems - meaning they open and close trades during the same trading session. For example you can see with our system, Apollo Algo, it is a swing trading system with an average hold time of over 3 days.

Why Would A Trader Share Their Trading Strategies And Platform?

Some systems we purchase the commercial rights to, others we have arrangements with the developer and trader that financially motivates them, and some traders don’t have an automated system, but have a great strategy, and we will actually have our developers code an algorithm and provide it to them, so they can run it on an automated basis as well to streamline their workflow. Overall we have a unique business model that works for everyone involved.

Do I Need To Download Anything Or Leave It On To Execute Trades?

No. This is entirely cloud based. We run the trading program and algorithms on our own servers, which transmit directly to our platform, which sends the signal to your brokerage. You don’t even need to have a computer turned on. Just set it up once, turn it on, and that’s it. No participation from you is required at all beyond originally turning it on and managing your settings based on your risk tolerance and goals.

Does Algo Exchange Utilize Black Boxes, Gray Boxes, Or White Boxes?

Algo Exchange uses Black Box, which restricts the user from seeing or understand the rule set or logic for the trading system. A gray box would be where some of the logic is transparent, for example, perhaps a risk layer. And a white box would be where it's totally transparent.

Does Algo Exchange Develop And Maintain Their Trading Algorithms?

All of the systems that run on our platform are built and developed by various quants that we work with. We do have an in house developer, but we also work with some existing strategies from traders that are in our network. Our founder works with many different traders and developers to build up a diverse library of trading systems. We also work with traders who provide us logic and we turn it into code, so overall our systems come from multiple talented traders.

What Happens If There Are Updates To My Rulesets By The Developers?

It is instantly updated onto the production version on our platform. Market environments are ever changing and may require updates on the backend to ensure performance. It’s part of the industry and we always make sure that when an update is ready and pushed into production that it is live on the platform. All of our systems do go through testing cycles, first on historical data, then on live data to make sure everything is effective, and then it is published for use on the site.

How Is The Plumbing Configured And How Does The IT Look?

All of our systems run on servers. From there when a trade is triggered from any system, it is fired over to our platform API, and is then fired to the brokerage API to execute the trade for you.

Does Lag Between The Servers And My Account Effect The Performance?

No. Since we do not have High Frequency Trading systems and our algorithms have decent sized targets on top of us using high performance servers next to data centers, the low latency does not effect the trade outcomes in a significant way. There may be a tick or two of slippage, but overall it is not detrimental.

Does Algo Exchange Guarantee Any Type Of Performance?

No. Past Performance is not indicative of future results. Algo Exchange does NOT guarantee performance.

Does Algo Exchange Make Any Recommendations On Which Strategies To Use?

No. It is entirely the user’s choice on what strategies to use. Algo Exchange simply offers users with the ability to connect any of our trading algorithms to their own account. Algo Exchange does not give personalized advice or recommendations. All of our servers have backup power in terms of battery back ups for each machine, and the building has a generator as well, so two back up power sources. We also have backup fiber optic internet in case the main fiber line goes down. Up time is very important and we do our best to have the best resources we can.

Seeking Clarity?

Schedule A Video Call For A Comprehensive Guide Through Our Platform!

Subscribe To Algo Exchange & Discover The Benefits of Trading Algorithms

Receive valuable tips, news, and special promotions!

DISCLOSURE: Trading involves significant risks. Our algorithms are based on simulated data with inherent limitations and may not accurately predict actual market conditions. While our algorithms are rigorously tested, their past performance does not guarantee future results. Always approach trading with caution and consider potential risks before utilizing any algorithm. For additional disclosure information, click HERE

Copyright © 2026 Algo Exchange. All Rights Reserved.